DHMH 440 1997-2025 free printable template

Show details

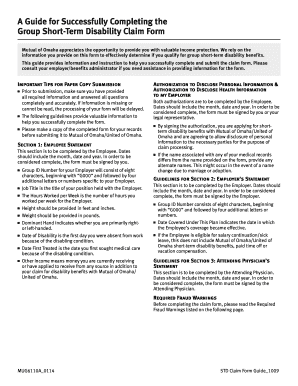

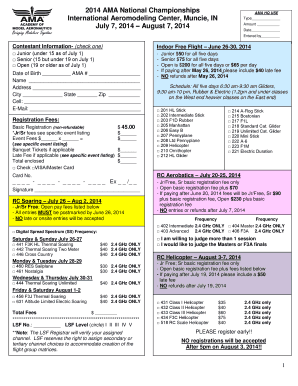

DEPARTMENT OF HEALTH AND MENTAL HYGIENE HUMAN SERVICE AGREEMENTS ANNUAL REPORT DHMH 440 SECTION I. VENDOR NAME AWARD VENDOR ADDRESS STATE FISCAL YEAR CITY/STATE/ZIP REPORTING PERIOD PROJECT TITLE TOTAL DHMH AWARD TELEPHONE NUMBER SIGNATURE TO BLUE INK DIRECTOR S NAME DATE FEDERAL EMPLOYER ID SUMMARY OF RECEIPTS SUMMARY OF EXPENDITURES FINAL APPROVED LINE ITEMS MAY ACTUAL UNDER BUDGET EXPENDITURES OVER FRINGE CONSULTANTS EQUIPMENT PURCHASE OF SERVICE RENOVATION CONSTRUCTION REAL...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dhmh 440 form

Edit your federal income refunds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal refunds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax estimated cost online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit state tax delinquency form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estimated refunds form

How to fill out DHMH 440

01

Obtain a copy of the DHMH 440 form from the appropriate health department or website.

02

Begin filling out the form by entering your personal information in the designated sections, such as name, address, and contact details.

03

Provide any relevant medical history or health information as requested on the form.

04

Complete the specific sections related to the purpose of the form, ensuring that all required fields are filled out accurately.

05

Review your entries for any errors or missing information before submission.

06

Sign and date the form at the end, if required.

07

Submit the completed form as instructed, either in person or via the specified method (e.g., email, mail).

Who needs DHMH 440?

01

Individuals applying for certain health services or benefits through the Department of Health and Mental Hygiene.

02

Healthcare providers who require documentation for patient services.

03

Researchers or organizations needing to compile health-related data for studies or reports.

Video instructions and help with filling out and completing tax income refunds

Instructions and Help about state federal estimated

Fill

state tax cost form

: Try Risk Free

People Also Ask about federal tax estimated

Do I need to mail my w2 with my tax return?

You don't need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return. Use Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-File Return to submit any paper documents that need to be sent after your return has been accepted electronically.

How can I add my direct deposit for tax refund?

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.

What supporting documents do I need to mail in my tax return?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

What documents do I need to mail with my tax return?

These include: A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other tax-deductible expenses if you are itemizing your return.

How do I figure out my federal refund?

Check your federal tax refund status Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can call the IRS to check on the status of your refund.

What is the correct way to file a federal income tax return?

Choose how to file taxes There are three main ways to file taxes: fill out IRS Form 1040 or Form 1040-SR by hand and mail it (not recommended), file taxes online using tax software, or hire a human tax preparer to do the work of tax filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is federal refunds?

Federal refunds are monetary reimbursements issued by the government to taxpayers who have overpaid their federal taxes. Individuals and businesses may receive a federal refund if their tax liability is lower than the amount of federal income tax withheld or paid throughout the year. The excess amount is refunded by the Internal Revenue Service (IRS) after the tax return is processed.

Who is required to file federal refunds?

Every individual and business entity that has earned income within a tax year may potentially be required to file federal tax returns and apply for refunds. The specific threshold for filing requirements depends on factors such as filing status, age, and income level. Generally, individuals with income below a certain threshold may not be required to file, while businesses are typically obligated to file regardless of income. It is advisable to consult the Internal Revenue Service (IRS) or a tax professional for accurate and up-to-date information regarding filing requirements for federal tax refunds.

How to fill out federal refunds?

To fill out a federal tax refund, follow these steps:

1. Gather your tax documents: Collect all the necessary tax documents such as W-2s, 1099s, and any other income statements you receive from employers or financial institutions.

2. Choose the right form: Determine which tax form to use. Most individuals use Form 1040 or Form 1040A. Form 1040EZ can be used if you have a very simple tax situation.

3. Fill in your personal information: Provide personal details such as your name, address, and social security number.

4. Report your income: Enter all your income from various sources, including wages, dividends, interest, and any other taxable earnings. Use the appropriate lines on the form for each type of income.

5. Deduct eligible expenses: Consider deducting any eligible expenses such as student loan interest, medical expenses, or contributions to retirement accounts. Refer to the instructions for the specific form you are using to ensure you claim all applicable deductions.

6. Calculate your tax liability: Use the tax tables or the applicable tax rate schedule provided with the form to calculate your tax liability based on your income and deductions.

7. Claim tax credits: If you qualify for any tax credits, such as the Earned Income Tax Credit or the Child Tax Credit, fill in the appropriate sections to claim these credits.

8. Calculate your refund: After determining your tax liability, subtract any tax withheld from your paychecks throughout the year, as well as any other credits you are eligible for. This will give you the amount of your estimated refund.

9. Sign and date the form: You must sign and date your tax return to make it valid. If you are filing jointly, both you and your spouse must sign.

10. Submit your return: Mail your completed tax return to the appropriate IRS address listed in the instructions for the form you are using. Alternatively, you can electronically file your return using tax software or an authorized e-file provider.

Remember to always double-check your information and seek guidance from a tax professional or the IRS if you have any specific questions or concerns about your federal tax refund.

What is the purpose of federal refunds?

The purpose of federal refunds is to return excess money that taxpayers have paid to the government throughout the year in the form of income tax withholding or estimated tax payments. When an individual's tax liability is lower than the amount they have already paid, the government issues a refund to return the overpaid amount. Federal refunds provide taxpayers with the opportunity to claim any excess funds and serve as a mechanism to ensure that individuals do not overpay their taxes.

What information must be reported on federal refunds?

When reporting federal refunds, the following information must be provided:

1. Taxpayer Identification Number: This is usually your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

2. Filing Status: Indicate your filing status, such as Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er) with Dependent Child.

3. Taxable Income: Report your total taxable income for the year.

4. Taxes Withheld: Include the amount of federal income tax withheld from your wages, salaries, pensions, or other income sources.

5. Credits and Deductions: If applicable, report any tax credits or deductions that you qualify for, which reduce your overall tax liability.

6. Tax Payments: Provide information about any estimated tax payments made during the year or any additional tax paid with your extension request.

7. Adjustments: Report any adjustments made to your income or deductions, such as contributions to retirement accounts or student loan interest deductions.

8. Refund Amount: Finally, provide the specific amount you are claiming as a refund.

The exact information required may vary based on individual circumstances or changes in tax laws. It is advisable to refer to the official IRS forms and instructions for accurate reporting of federal refunds.

How can I manage my federal tax cost directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your federal estimated as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send state tax income for eSignature?

federal tax refunds is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I edit tax estimated on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing tax income, you can start right away.

What is DHMH 440?

DHMH 440 is a form used by the Maryland Department of Health to report certain health-related data and statistics.

Who is required to file DHMH 440?

Healthcare providers, facilities, and entities that are subject to reporting requirements under Maryland law are required to file DHMH 440.

How to fill out DHMH 440?

To fill out DHMH 440, obtain the latest version of the form from the Maryland Department of Health's website, provide accurate information in all required fields, and submit it by the specified deadline.

What is the purpose of DHMH 440?

The purpose of DHMH 440 is to collect and analyze health data to improve public health policies and programs in Maryland.

What information must be reported on DHMH 440?

DHMH 440 requires the reporting of data related to patient demographics, health outcomes, services provided, and any relevant statistical information as mandated by the state.

Fill out your DHMH 440 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Refunds is not the form you're looking for?Search for another form here.

Keywords relevant to federal estimated income

Related to state tax estimated

If you believe that this page should be taken down, please follow our DMCA take down process

here

.